PAY YOURSELF FIRST - OUR #1 RULE!

We can educate you on so many different financial strategies, from investing to saving tax, protecting your loved ones and so much more. But when it comes to being a financial winner and building future financial wealth, the most important strategy we need to stress (and have stressed over and over) is to ensure you pay yourself first!

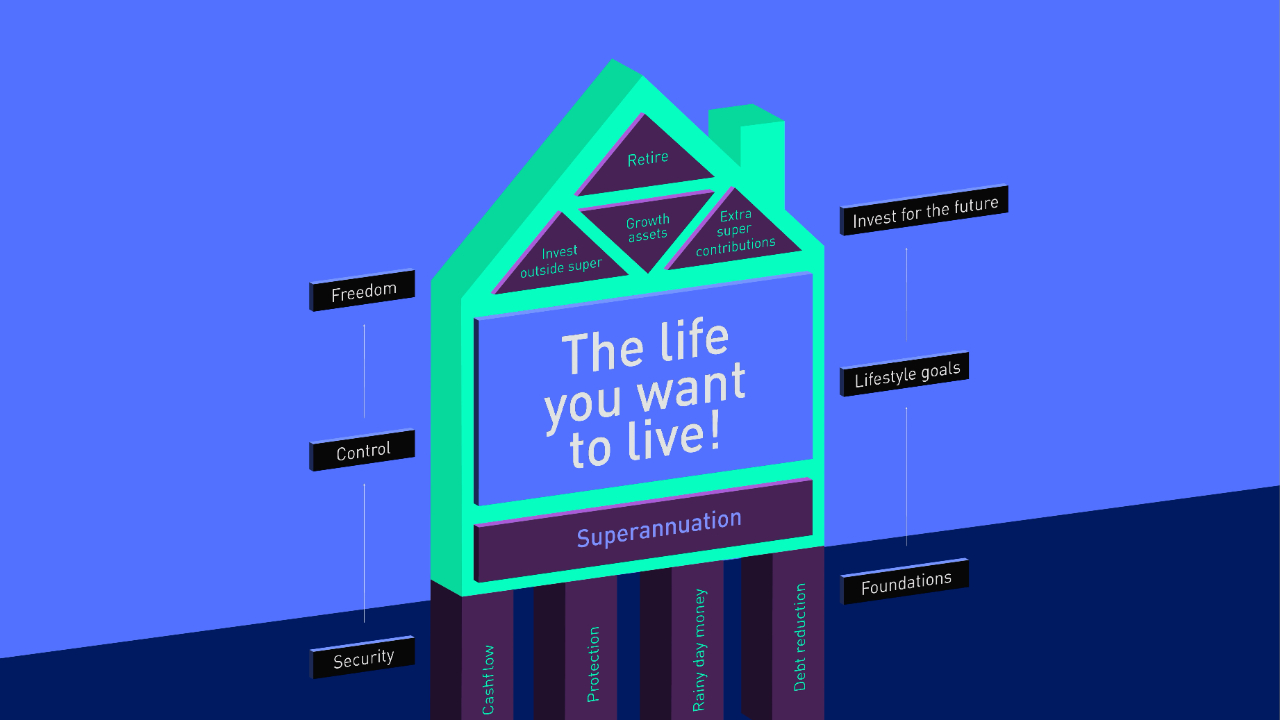

Paying yourself first sits as a foundation of your financial house under cashflow and just about every single independently-minded financial guru will tell you it’s the golden rule for anyone wanting to be financially successful.

The concept is so simple that anyone can do it: To pay yourself first all you need to do is transfer a portion of every pay cheque you receive to something for your future self, before you go spending it on bills, groceries, a pair of shoes you could possibly do without, or the newest iPhone on the market.

It’s so simple! But simple is not the same as easy. It’s two things: consistency and discipline.

If you can pay yourself first consistently and with discipline, it will change your life, and not just financially, mentally too! Money is the number one cause of stress and while paying yourself first won’t necessarily take any current financial stress, your future self will be very thankful for what you start doing now.

Way too often we hear how hard it is for people to get started on improving their financial journey. Where to start, what to do, when to do it??? The great thing about paying yourself first is that you can dive straight in. You can get started with your very next pay cheque. You don’t need to start big, you just need to start and then build on it from there. Kind of like getting in the shallow end of the pool where you can stand and gradually start to swim your way to the deep end.

The good news is almost everyone finds out that paying themselves first works! It works because you save first, rather than trying to save what’s left over… which almost never works.

And there’s a domino effect. As soon as you pay yourself first, you have savings to allocate to something or somewhere, and therefore you are gently pushed into ticking off other financial tasks on your list. For example, you can pay off the credit card, you can put together your Rainy Day fund, salary sacrifice to super, extra mortgage repayments, a stocked travel fund (to name a few).

And it doesn’t stop there as you’ll also find that you start to pay attention to what you are actually spending your money on each pay cycle. Without even knowing it you will be starting to draft your very own conscious spending plan, identifying fixed essential costs, what you are choosing to spend money on and just how much all these costs add up to.

From our experience, people then start to cost hack essential expenses, seeking better value for their money, they also eliminate wasteful choice spending. Why you ask? Because all of a sudden, they have awareness, they become a little (or a lot) more interested in saving and investing and watching their financial house (and prosperity) grow.

This is why paying yourself first is so powerful. We want all of you to have a go at paying yourself first now. It doesn’t matter how much you set aside, just do it! Even if it’s $20 per fortnight, the mere act of taking this step is huge and will very likely be the first small step you take to achieving massive change!

From there, you can increase the amount every time you get a pay rise. This is called Save More Tomorrow and has been scientifically proven to work because it makes it easy… a story for another day (or take a peep at Module 4 within Wages to Wealth).

The other story is that while this is so important in terms of financial success, it’s not as easy as just saving. You will never save your way to financial success; you need to at some point turn savings into investments. But the simple reality is that you will never be able to invest if you can’t save. It’s putting one foot in front of the other.

We’ve laid it all out for you in Module 6 of the Wages to Wealth program!

Grab your phone, go to your banking app, double check what day you get paid and then set up your automated money transfer to pay yourself first.

We’d love to hear from you once you tick this action off – reach out to us at [email protected] and tell us about your achievement or if anything in particular worked for you.

Cheers,

Dan and Dave