Simplicity Over Complexity!

With the holiday period around the corner, we hope you get a chance to slow down and take some time out for yourself. With that being the case, you may just start thinking about your money and finances and that can become a dangerous thing! So take this as us reminding you that keeping your financial affairs simple is what works, and it's almost always all that is needed. Instead of thinking about how to find the next billion-dollar start-up, start taking action and ticking off modules within our Wages to Wealth program. It's full of smart yet simple advice strategies built for all of us!

We’ve made no secret of the fact that we believe that the financial world has been built with other people’s agendas front and centre. If we put that another way, the financial world is built with your needs nowhere near the top of the list.

In order to keep this priority of interests, complexity is the aim of other people’s games, and it is sold to you as an essential ingredient that you need in order to achieve the best outcomes. In reality, this is simply smoke and mirrors, designed to have you part with money to pay others to manage the complexity and keep you thinking it’s the best way forward for you. Remember, everyone has an agenda, so you need to work out who has your agenda as their priority.

Check out some of the jargon – ASX200, gearing, debentures, put options, warrants, core satellite, high yield savings accounts, exchange traded funds, NASDAQ, high conviction stock, micro caps, emerging markets, hybrids and the list goes on and on… are you confused yet? And what about the thousands of managed funds and stocks out there? Maybe you’ve fallen asleep? We get so bamboozled by all the choices that we end up getting taken advantage of, or sticking our heads back in the sand.

Information overload and analysis paralysis can often mean that even when we have the best of intentions and know we need to make changes, we freeze and find it safer to just continue with the status quo.

The financial world tries to tell us that we need to be smarter and more sophisticated so we can win the race. How do we do that? Whose race are we running? We often end up paying high product fees and potential commissions to providers, advisers and brokers that could easily be avoided.

The reality is that money management is best when it is simple and low-cost. It’s all about focusing on the things we can control and ignoring the things we can’t. And ideally, you should understand what is going on and why you are doing what you’re doing with your money. When you feel confident about the plan, you’ll stick with the plan.

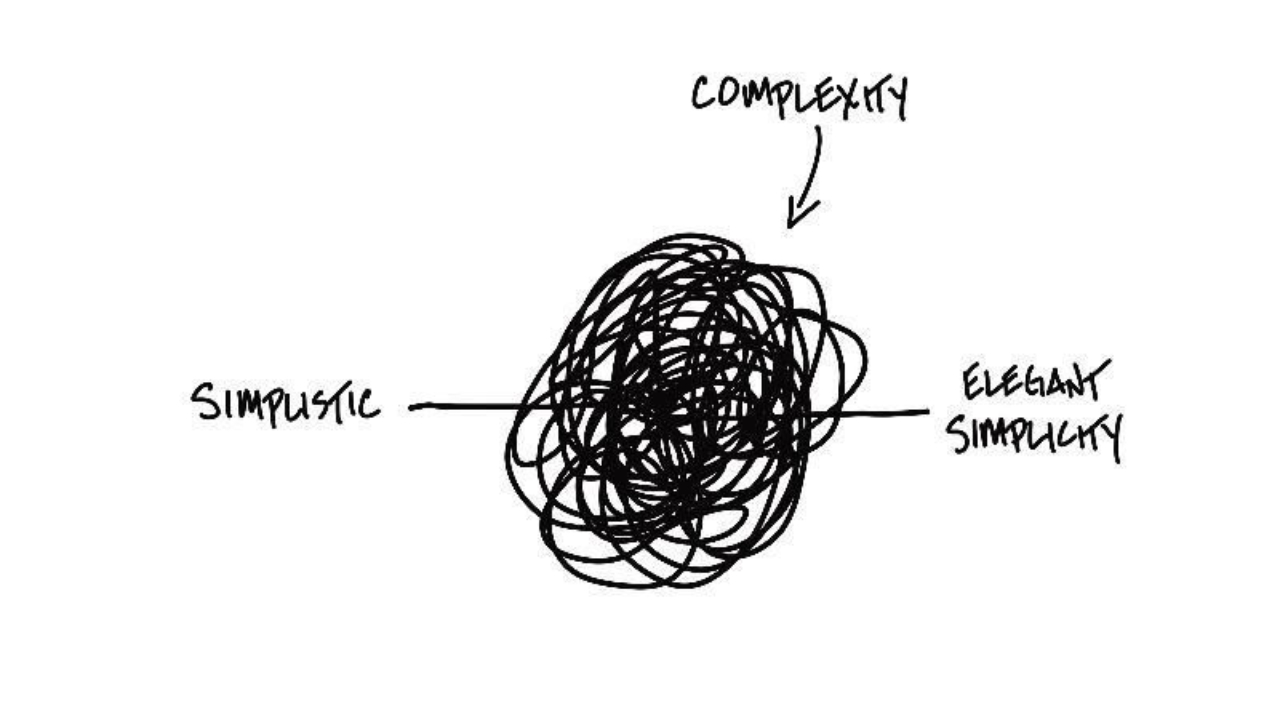

Carl Richards is a financial adviser in Utah in the United States. He’s become famous as The Sketch Guy, who has a great way of explaining concepts through simple diagrams. And as you can see in his diagram above, there is a difference between 'simplistic' and 'elegant simplicity'... the trick is avoiding complexity!

You probably have questions, and the good news is that we have A LOT of the answers.

If you would like to learn more about investing, please jump into the Wages to Wealth program and select the Investing module. We have provided key education and learnings, as well as up-to-date investment recommendations. If you get a thirst for more, there is also a module all about superannuation, how to invest your benefits and there are product recommendations you can review and apply. Insurance, investing for kids, spending and saving, Wills? We’ve got it all and much more. And if you need help, we’re here waiting for your email…

Keep things simple. Small steps lead to big results. Save a little money a lot of the time, invest regularly, and make sure that your best interests are being put first by others.

Cheers,

Dan and Dave